Assessing an individual's financial standing often involves evaluating their net worth, a critical measure encompassing total assets minus liabilities. A relatively low net worth, indicative of limited financial resources, can stem from various factors, including income level, expenses, investment choices, and life events. This financial profile can significantly influence an individual's options and capabilities across multiple areas of life, from personal finances to broader economic participation.

Understanding the implications of a low net worth is crucial. Such individuals might face limitations in accessing financial products, securing loans, or achieving personal financial goals. In certain contexts, this can affect access to necessities or opportunities. While a low net worth isn't inherently negative, it's an important consideration in various economic analyses and personal planning frameworks. Recognizing the factors contributing to, and mitigating, this financial profile is essential for holistic financial planning and informed decision-making.

This understanding forms a cornerstone for a wider exploration of individual and collective financial circumstances. This discussion can then inform policies and interventions aimed at economic empowerment and stability. Following are detailed analyses of relevant factors impacting wealth accumulation, such as economic policies and individual investment strategies.

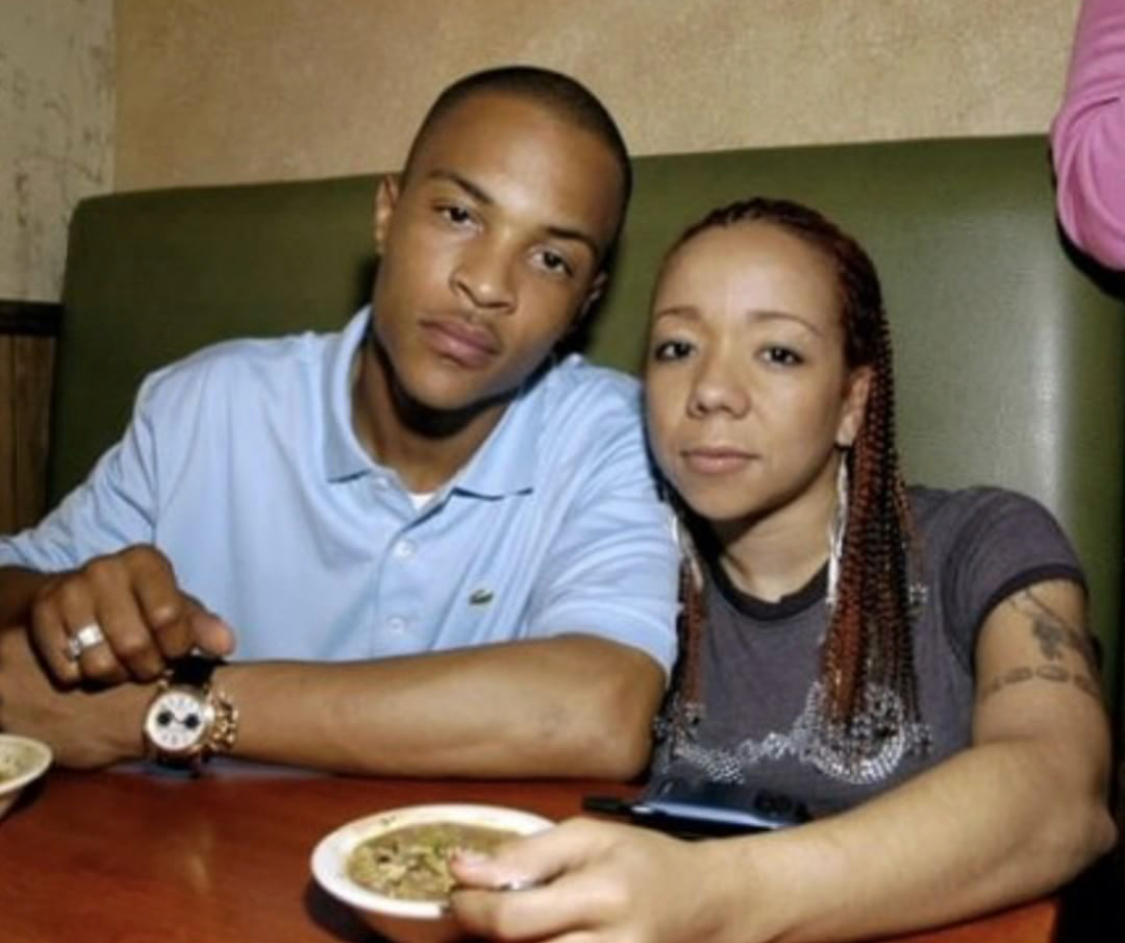

Ti and Tiny Net Worth

Understanding "ti" and "tiny" net worth involves recognizing factors influencing an individual's financial standing. These aspects collectively depict a limited financial capacity, crucial to analyses across various economic contexts.

- Income levels

- Expenditures

- Asset accumulation

- Debt burden

- Investment strategies

- Financial literacy

- Economic conditions

These factors interact intricately. Low income and high expenditures contribute to a "ti" or "tiny" net worth. Insufficient asset accumulation, coupled with a high debt burden, further exacerbates the issue. Lack of financial literacy can impede prudent investment strategies, hindering wealth building. External economic conditions, like recessions, can also significantly impact individuals' ability to accumulate wealth. For instance, individuals facing job losses or market downturns experience a reduction in assets, leading to a decrease in net worth. Consequently, comprehending the interplay of these elements is vital for understanding and addressing situations characterized by low net worth.

1. Income Levels

Income levels are a primary determinant of net worth, especially in cases of "ti" or "tiny" net worth. A person's earnings directly influence their ability to accumulate assets and manage liabilities. Low income often restricts access to resources needed for wealth building.

- Impact on Asset Accumulation

Limited income directly restricts the amount available for savings and investments. Individuals with low incomes must prioritize essential expenditures, leaving little room for accumulating assets, such as investments, real estate, or retirement funds. This restriction fundamentally limits the growth of net worth, often resulting in a "ti" or "tiny" net worth. Examples include families supporting multiple dependents with low-wage jobs, single individuals with minimal income from part-time work, or populations living in areas with low-wage job markets.

- Influence on Debt Management

Low income often necessitates reliance on debt to meet essential expenses. Individuals with low incomes may use credit cards or take on high-interest loans to cover immediate needs. The interest payments on these debts can erode any available resources and significantly reduce net worth. For instance, a student might use a credit card for tuition and daily expenses while limited income and debt accumulate.

- Correlation with Expenditure Patterns

Income directly correlates with expenditure patterns. Individuals with low incomes frequently allocate a larger percentage of their resources to necessities. This leaves less disposable income for savings, investments, or other activities promoting wealth accumulation. For example, a person with a minimum wage job may spend most of their earnings on housing, utilities, and food.

- Long-term Implications for Financial Security

Persistent low income, coupled with inadequate savings, can create long-term financial insecurity. This can extend to challenges in securing a home, planning for retirement, and navigating unexpected events. This is especially true in countries with persistent income inequality or significant economic instability.

In summary, income levels are fundamentally linked to the attainment and maintenance of "ti" or "tiny" net worth. Individuals with limited income face significant obstacles in accumulating assets, managing debt effectively, and achieving financial security. Addressing these challenges requires a holistic approach considering factors beyond income alone.

2. Expenditures

Expenditures play a critical role in shaping net worth, particularly in situations where net worth remains low or "ti" and "tiny." Understanding expenditure patterns is essential for recognizing the factors contributing to financial constraints and for developing strategies to improve financial well-being. The relationship between expenditures and net worth is fundamentally one of resource allocation: how funds are spent directly impacts the ability to accumulate assets and reduce liabilities.

- Essential Expenditures and Financial Constraints

A disproportionate allocation of income to essential expenditures, such as housing, food, and utilities, can leave minimal resources for savings or investments. Individuals experiencing financial hardship often find themselves with very little discretionary income. This can lead to a vicious cycle, where limited savings prevent building an emergency fund, leading to further reliance on credit or loans. In extreme cases, individuals might be forced into a cycle of increasing debt to meet essential needs. Examples include families with multiple dependents relying on a single, low-income earner or individuals living in high-cost-of-living areas.

- Unplanned Expenses and Emergencies

Unexpected expenses and emergencies can significantly impact an individual's net worth. These unforeseen events often require significant financial resources, potentially draining savings and leading to an increase in debt. Medical emergencies, vehicle repairs, or natural disasters are often unforeseen and can be substantial drains on resources, especially for those with "ti" or "tiny" net worth. The lack of an emergency fund can exacerbate the consequences of such events.

- Consumer Debt and Revolving Spending Habits

High levels of consumer debt, revolving credit card spending, and installment loan payments frequently contribute to low or negative net worth. The interest accrued from these forms of debt eats into disposable income and further restricts the ability to build assets. This cycle of debt can quickly reduce net worth, making it increasingly difficult to achieve financial stability.

- Lifestyle Choices and Expenditures

Lifestyle choices impacting expenditures significantly influence net worth. High discretionary spending on non-essential items or excessive spending on experiences, often without careful consideration of their impact on financial resources, can contribute to a low net worth. A lack of awareness or foresight regarding expenditure levels can lead to a consistent strain on personal resources.

In conclusion, expenditures are a crucial component in assessing and understanding individuals with a "ti" or "tiny" net worth. Effective financial management requires careful consideration of expenditure patterns, addressing both essential and discretionary spending to create a better financial future.

3. Asset Accumulation

Asset accumulation is a crucial component of net worth, particularly relevant when considering individuals with "ti" or "tiny" net worth. A lack of asset accumulation is frequently a direct cause of this low financial standing. Assets, including investments, property, and savings, represent potential value and financial security. The absence of these assets directly correlates with limited resources available to address financial obligations and pursue future goals. For instance, an individual with minimal savings and no property investments faces significant challenges securing loans, planning for retirement, or navigating unexpected financial difficulties.

The importance of asset accumulation for those with a "ti" or "tiny" net worth cannot be overstated. It represents a crucial element in building financial resilience. Individuals with limited assets are often vulnerable to economic shocks and less equipped to handle unexpected expenses or long-term financial needs. Consider a scenario where a family's sole asset is a modest savings account. A sudden medical emergency or job loss could quickly deplete these savings, leaving them in a precarious financial position. In contrast, individuals with diversified assets, even if modest in total value, possess a wider range of resources and options to cope with unforeseen events and achieve their financial goals.

Understanding the link between asset accumulation and low net worth is essential for both individual financial planning and broader societal economic analyses. For individuals, it highlights the need for consistent saving and investment strategies, even with limited income. It underscores the significance of building an emergency fund and exploring various investment avenues, such as retirement accounts or low-cost index funds. On a broader scale, this understanding informs policies and initiatives promoting financial literacy and accessibility to investment opportunities, especially for those with limited financial resources. These strategies can improve overall economic stability and reduce the vulnerability of individuals with "ti" or "tiny" net worth.

4. Debt burden

A substantial debt burden is frequently a defining characteristic of individuals with a low or "ti" and "tiny" net worth. High levels of debt directly reduce net worth, often representing a significant portion of an individual's assets or even exceeding the total value of assets. The burden of debt manifests in various forms, including credit card balances, outstanding loans, and accumulating interest charges. These financial obligations can quickly consume available income, restricting opportunities for saving and investment, further compounding the problem.

The relationship between debt burden and low net worth is a cyclical one. Individuals may incur debt to meet immediate needs, such as covering unexpected expenses or affording essential goods. However, without adequate income or effective debt management strategies, accumulating debt can quickly become unsustainable. High interest rates associated with various forms of debt, such as credit cards and personal loans, compound the problem, making it increasingly difficult to repay the principal and accumulating interest. This accumulation of debt invariably contributes to a "ti" or "tiny" net worth, often resulting in a downward spiral where limited financial resources are continuously depleted and further financial obligations become more challenging to manage. For example, individuals with multiple outstanding loans might find it nearly impossible to save, even with a modest income, or they may sacrifice investments, potentially jeopardizing long-term financial security. Further complicating matters, the debt burden may restrict access to essential resources and opportunities, perpetuating a cycle of financial instability.

Understanding the impact of debt burden on low net worth is critical. Effective financial planning often necessitates proactively managing and reducing debt. This includes developing a budget that prioritizes debt repayment, consolidating debts with lower interest rates, and exploring strategies for increased income. Moreover, recognizing the interconnected nature of debt and low net worth is crucial in developing effective financial support programs. Interventions focused on debt management education, financial literacy, and responsible lending practices are likely to have a greater impact on improving the financial well-being of those with a "ti" or "tiny" net worth.

5. Investment Strategies

Investment strategies play a significant role in shaping an individual's net worth, particularly for those with a "ti" or "tiny" net worth. Limited resources necessitate careful consideration of investment options, aiming for optimal returns while minimizing risk. Effective strategies often involve understanding risk tolerance, financial goals, and the potential impact of various investment instruments.

- Risk Tolerance and Diversification

Individuals with a low net worth often have limited capital for investment. A key aspect of effective strategy involves aligning investment choices with risk tolerance. High-risk, high-reward options might be unsuitable for those seeking stability. Instead, a strategy of diversification, spreading investments across different asset classes, minimizes the impact of potential losses in any single investment. Examples include allocating funds to low-cost index funds, bonds, or certificates of deposit. The potential benefits lie in mitigating risk and maintaining capital, crucial when net worth is limited. This approach is frequently more appropriate than high-risk options.

- Accessibility and Affordability

Investment strategies for those with a low net worth need to be both accessible and affordable. Complex strategies requiring high upfront investments or substantial management fees may be inappropriate. Instead, low-cost options are preferable. The focus should be on investments that require minimal initial capital and low ongoing fees. Examples include online brokerage accounts with zero or low minimum balances and automated investment platforms offering fractional shares. This accessibility expands investment opportunities for individuals with limited resources, without excessive barriers to entry. The implications for those with a "ti" or "tiny" net worth are significant, opening avenues for early wealth building.

- Financial Goals and Time Horizons

Investment strategies should align with specific financial goals and time horizons. Short-term goals, such as building an emergency fund, might require more liquid investments than long-term goals, like retirement planning. A clear understanding of the investment timeframe is paramount. For those with limited net worth and short-term goals, high liquidity is paramount. The investment strategy should support the timeframe of the goal. For individuals with "ti" or "tiny" net worth, short-term investment strategies might focus on high-yield savings accounts or short-term government bonds, providing access to funds for immediate needs while allowing for eventual growth.

- Education and Professional Guidance

Developing effective investment strategies is often aided by education and professional guidance. Understanding basic financial principles, market dynamics, and investment options equips individuals to make informed decisions. Seeking guidance from qualified financial advisors can be valuable for customized strategies. Investment education empowers individuals to navigate the complexities of financial markets, maximizing the potential of limited resources. This is particularly relevant for those with a "ti" or "tiny" net worth, as professional advice can help avoid pitfalls and build a solid foundation for future growth.

In conclusion, effective investment strategies for those with "ti" or "tiny" net worth emphasize diversification, accessibility, alignment with financial goals, and continuous learning. By understanding these principles, individuals can build a foundation for sustainable wealth growth, even with limited resources, potentially addressing the challenges associated with a low net worth.

6. Financial Literacy

Financial literacy plays a pivotal role in individuals with "ti" or "tiny" net worth. A lack of financial literacy often exacerbates existing financial constraints, hindering the ability to build and maintain wealth. Conversely, possessing a strong foundation in financial knowledge can significantly improve outcomes, even with limited resources. This includes understanding essential concepts like budgeting, saving, investing, and managing debt.

Individuals with limited financial literacy might struggle with budgeting, leading to overspending and accumulating debt. They may not fully grasp the long-term implications of high-interest debt or the benefits of saving and investing, even with small amounts. This lack of awareness can result in a perpetuation of low net worth. For instance, a young adult with limited income and little understanding of credit cards might accrue significant debt without recognizing the escalating interest charges and long-term impact on their financial health. Similar situations arise with individuals unfamiliar with basic investment principles, leading them to poor investment choices that erode their limited savings or fail to appreciate the long-term benefits of compound interest. Conversely, individuals with strong financial literacy can create and follow a budget, understand how loans and credit cards work, and make informed investment decisions. Even small savings, combined with a solid understanding of financial principles, can lead to growth over time, potentially mitigating the impact of a "ti" or "tiny" net worth.

The practical significance of understanding this connection is substantial. Individuals can employ strategies for improved financial well-being by improving their financial literacy. Financial literacy empowers informed choices, promoting prudent use of resources and efficient debt management, which can be particularly beneficial for those with limited financial resources. Furthermore, educational programs focused on financial literacy, particularly within vulnerable populations, can be instrumental in building resilience and creating a more stable economic landscape, offering a path towards wealth building for individuals with "ti" and "tiny" net worth. Ultimately, financial literacy is not just about acquiring knowledge, it's about acquiring skills for managing one's financial resources and striving for greater financial security and freedom, regardless of income level.

7. Economic Conditions

Economic conditions significantly impact an individual's net worth, particularly when that net worth is low or characterized as "ti" and "tiny." Economic fluctuations, such as recessions or periods of high inflation, can profoundly influence income levels, job availability, and the cost of essential goods and services. These factors directly correlate with the accumulation and maintenance of wealth, often determining whether an individual's financial position remains stagnant or deteriorates.

A period of economic downturn, for example, frequently leads to job losses, reduced wages, and decreased investment returns. These factors contribute to a reduction in disposable income, making it harder for individuals with limited financial resources to save or increase their assets. Conversely, rising inflation erodes the purchasing power of savings and wages, effectively lowering the real value of an individual's net worth. Even modest savings can lose significant value during periods of high inflation. This exemplifies the critical role economic conditions play in determining an individual's financial trajectory. Consider a family with a "ti" net worth: a significant job loss during a recession could quickly deplete their limited savings and increase their debt burden, making it even harder to recover financially.

Understanding the interplay between economic conditions and low net worth is crucial for developing effective financial strategies and policies. Financial planning for individuals should incorporate a realistic assessment of the economic climate. Economic forecasts and analyses offer valuable insights into potential future challenges and opportunities. On a broader scale, policymakers can implement strategies to mitigate the adverse effects of economic downturns on vulnerable populations. These could include targeted support programs for job training, unemployment benefits, and affordable access to credit for individuals who experience a decrease in income or increased financial strain due to economic instability. This knowledge empowers individuals to develop more resilient financial strategies and provides governments with tools to build more robust economic safety nets.

Frequently Asked Questions about Low Net Worth

This section addresses common inquiries regarding individuals with limited net worth, often characterized as "ti" or "tiny." The following questions and answers aim to clarify key aspects of this financial profile.

Question 1: What are the primary factors contributing to a low net worth?

Answer: Factors contributing to low net worth encompass various elements. These include low income levels, high expenditures (often prioritized on essentials), substantial debt burdens (high levels of credit card debt, loans, or other financial obligations), limited asset accumulation, and poor financial literacy. Economic conditions, such as recessions or high inflation, can also significantly impact an individual's ability to maintain or grow their net worth.

Question 2: Is a low net worth always a negative indicator?

Answer: A low net worth isn't inherently negative. It reflects a current financial status and can stem from various circumstances. For example, a young professional starting their career, a recent graduate facing student loan payments, or someone experiencing a temporary economic hardship may have a low net worth. However, consistently low net worth warrants attention and a plan to improve financial security.

Question 3: How does limited asset accumulation contribute to low net worth?

Answer: Insufficient asset accumulation is a critical component. A lack of savings, investments, or other assets directly reduces net worth. Limited capital restricts access to crucial financial resources during emergencies, making long-term financial stability more challenging.

Question 4: What role does financial literacy play in low net worth?

Answer: Financial literacy significantly impacts net worth. Individuals with poor financial literacy may struggle with budgeting, make poor investment decisions, or not fully understand the implications of debt. A lack of knowledge can lead to poor financial choices, further reducing the ability to accumulate and maintain wealth.

Question 5: How can individuals with low net worth improve their financial situation?

Answer: Strategies for improvement include creating and adhering to a budget, reducing debt through consolidation or repayment plans, developing and implementing saving and investment strategies aligned with individual goals, and seeking financial counseling or education to bolster financial literacy.

Question 6: What external factors influence an individual's net worth, particularly those with low net worth?

Answer: External factors significantly affect an individual's net worth. These include economic fluctuations (recessions, inflation), changes in employment markets, and unexpected events (medical emergencies, job loss). Understanding the influence of these external factors helps individuals and policymakers adapt to various economic conditions and implement strategies for increased financial resilience.

In conclusion, low net worth, often termed "ti" or "tiny" net worth, is a complex issue influenced by various internal and external factors. By understanding these elements, individuals can take proactive steps to improve their financial well-being and build financial security.

The following sections will delve into practical strategies and tools for enhancing financial stability and building wealth.

Improving Financial Well-being with Limited Resources

This section offers practical strategies for enhancing financial stability when facing limited resources and a "ti" or "tiny" net worth. These tips are designed to provide actionable steps for managing finances effectively and building a stronger financial foundation.

Tip 1: Prioritize and Track Expenses.

A detailed budget is crucial. Categorize expenditures (housing, food, transportation, entertainment, debt payments) to identify areas for potential reduction. Utilize budgeting apps or spreadsheets to track spending, aiding in identifying patterns and areas for optimization. This allows for focused efforts to address areas where expenses exceed income or are unnecessary.

Tip 2: Develop a Realistic Savings Plan.

Even small, consistent savings are beneficial. Establish an emergency fund a readily accessible reserve for unexpected expenses. Consider automatic transfers into a savings account to ensure regular contributions. Explore options for high-yield savings accounts or certificates of deposit to maximize the return on savings.

Tip 3: Manage and Reduce Debt.

High-interest debt, such as credit card debt, should be prioritized for repayment. Explore debt consolidation strategies to lower overall interest rates. Develop a debt repayment plan to reduce the financial burden and free up income for savings and investment. Avoid incurring further debt whenever possible.

Tip 4: Enhance Financial Literacy.

Financial literacy education is paramount. Understand basic financial concepts like budgeting, saving, investing, and managing debt. Resources include online courses, workshops, and financial advisors. Gaining knowledge empowers informed decision-making and proactive financial management.

Tip 5: Explore Investment Opportunities.

Even with limited capital, explore investment avenues. Low-cost index funds or ETFs offer a diversified approach to long-term growth. Explore online brokerage platforms for accessible investment options. Start small but consistent investment efforts can generate significant returns over time.

Tip 6: Seek Professional Guidance.

Consider consulting a financial advisor for personalized guidance. A financial advisor can offer tailored strategies based on individual circumstances, goals, and risk tolerance, helping to navigate the complexities of financial management and achieve greater financial security.

Implementing these tips consistently can significantly improve financial well-being even with a limited initial financial position. Consistent effort, coupled with a long-term perspective, is crucial for building a sound financial future.

Further exploration of these concepts and tailored strategies will be discussed in subsequent sections.

Conclusion

The exploration of "ti" and "tiny" net worth reveals a multifaceted issue impacting individuals across diverse economic contexts. Key factors consistently emerge as drivers of this financial profile: low income levels, high expenditures, substantial debt burdens, limited asset accumulation, and a deficiency in financial literacy. The interplay of these elements creates a complex challenge, often perpetuating a cycle of financial instability. Economic conditions further compound the issue, impacting income stability and the value of accumulated savings. Recognizing the interplay of these interconnected factors is crucial for both individual financial planning and broader economic policy development.

Addressing "ti" and "tiny" net worth requires a multifaceted approach. Individuals need practical strategies for managing expenses, building savings, and reducing debt. Financial literacy initiatives become critical in empowering informed decision-making. Furthermore, policies aimed at economic empowerment, job creation, and support for vulnerable populations are essential. Ultimately, a proactive approach, combining individual responsibility with supportive policy frameworks, is necessary to mitigate the challenges associated with low net worth and foster greater economic stability for all. The path toward improved financial well-being, even with limited resources, necessitates a commitment to consistent effort, informed decision-making, and a long-term perspective.

Article Recommendations

- Meet The Blackpink Members A Deep Dive

- Megan Fox Age In 2019 Then Now

- Uncover The Enchanting World Of Dawn Harper Insights From Aubrey K Millers Performance