The financial standing of a notable individual, often measured in currency units, is a significant metric in understanding their economic position. This information, when available, provides insight into wealth accumulation, investment strategies, and overall economic impact. For example, the financial resources of a prominent public figure might be a subject of public interest or influence perceptions about their success or standing.

Assessing an individual's financial resources is often relevant in various contexts. Public figures' net worth can be considered in the context of their influence, philanthropy, or industry standing. This understanding can potentially inform business decisions, investment strategies, or public discourse surrounding issues of wealth inequality or economic trends. Historical context plays a role as well, offering a glimpse into economic shifts and societal values over time. The value of such data lies in its capacity to provide a comprehensive perspective, rather than a singular snapshot.

This information is crucial to understanding the individual's public profile and influence. This article will now delve into relevant details on the individual's career path, accomplishments, and impact.

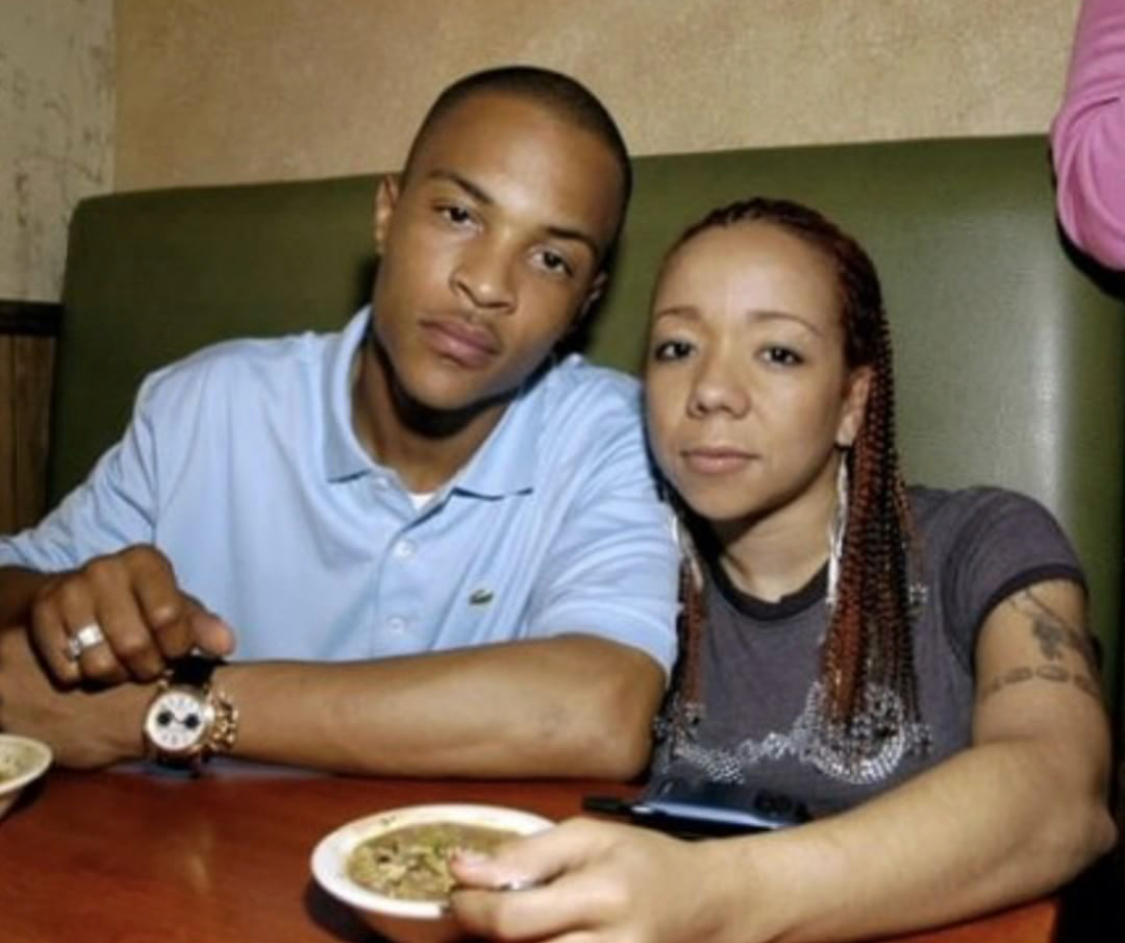

Tiny Ti Net Worth

Assessing net worth provides a glimpse into an individual's financial standing and economic impact. Understanding the factors contributing to this figure is crucial for a comprehensive perspective.

- Financial resources

- Investment strategies

- Wealth accumulation

- Career progression

- Industry trends

- Public perception

- Economic context

These aspects collectively shape an individual's financial position. For example, strong investment strategies and successful career progression often correlate with substantial wealth accumulation. Industry trends also play a role, as booms in certain sectors can lead to increased wealth for individuals within those fields. Public perception of a person, while not directly financial, can indirectly influence their worth by impacting the value of their brand or assets. Understanding all these factors provides a more nuanced picture than merely reporting a numerical figure, shedding light on the interplay between personal choices, industry influences, and economic shifts in the context of individual success.

1. Financial Resources

Financial resources, encompassing assets and income streams, are fundamental to understanding an individual's overall economic standing. In the context of an individual's net worth, these resources represent the tangible and intangible components that contribute to their financial position. A comprehensive analysis of financial resources provides valuable insights into the factors influencing net worth and its potential trajectory.

- Assets

Tangible assets, such as real estate, vehicles, and investments, form a significant portion of financial resources. The value of these assets varies based on market conditions, individual circumstances, and overall economic trends. For example, an appreciating real estate market can increase the value of a property, while a downturn in the stock market can decrease the value of investment holdings. These shifts directly impact an individual's net worth and highlight the dynamic nature of financial resources.

- Income Streams

Regular income, derived from employment, investments, or other sources, plays a crucial role in sustaining and growing financial resources. Consistent and substantial income allows for savings, debt repayment, and investment opportunities, all of which influence net worth. Different income streams, each with its own characteristics and volatility, contribute to the overall financial picture. For example, a steady salary from employment provides a stable foundation, whereas income from investments may fluctuate with market conditions.

- Debt Obligations

Outstanding debts, including loans, mortgages, and credit card balances, represent a crucial component of financial resources. These obligations, when contrasted with assets and income, can significantly influence net worth, either positively or negatively. High levels of debt can reduce net worth, while strategically managed debt can contribute to asset accumulation. Understanding the balance between debt and income is essential in evaluating an individual's financial health and its potential influence on overall net worth.

- Investment Portfolios

Investments, whether in stocks, bonds, or other financial instruments, form a crucial part of financial resources. The diversification and returns generated from these investments play a key role in the growth and evolution of net worth. Investment returns, affected by various economic factors, can significantly impact the overall value of an individual's assets and therefore influence their net worth.

In conclusion, understanding the interplay of assets, income streams, debt obligations, and investments provides a more comprehensive view of the individual's financial resources and their direct link to their overall net worth. This holistic approach helps appreciate the various contributing factors that shape an individual's financial position.

2. Investment Strategies

Investment strategies significantly influence an individual's net worth. The effectiveness of these strategies directly impacts the accumulation and growth of assets, ultimately shaping the overall financial standing. Successful strategies lead to positive returns, augmenting the value of investments, and consequently, enhancing net worth. Conversely, poorly conceived or executed strategies can result in losses, diminishing assets and reducing net worth.

Investment strategies encompass a range of approaches, each with varying levels of risk and potential return. Strategies like diversification across asset classesstocks, bonds, real estate, and othersaim to mitigate risk by spreading investments. Value investing, focused on identifying undervalued securities, seeks long-term growth. Growth investing, emphasizing companies with high potential for future growth, often involves higher risk. Active management, where a fund manager makes frequent adjustments to the portfolio, contrasts with passive management, which maintains a preset allocation. The appropriateness of a strategy depends on individual financial goals, risk tolerance, and time horizon. For instance, a younger investor with a longer time horizon might adopt a more aggressive growth strategy, while a retiree with a fixed income need may favor a more conservative approach. Real-life examples abound; successful entrepreneurs who leveraged investment strategies, often through venture capital or angel investing, saw dramatic increases in their net worth. Conversely, individuals who invested solely in speculative markets without due diligence often encountered losses, impacting their financial standing.

Understanding the connection between investment strategies and net worth is crucial for individuals seeking to build and maintain financial security. By carefully considering various investment approaches and tailoring strategies to their specific circumstances, individuals can optimize their financial outcomes. The selection and application of an appropriate investment strategy are essential components of long-term wealth building and the enhancement of financial health. This principle holds across the spectrum of financial situations, from personal investments to complex financial planning by professionals. Without a well-defined and implemented strategy, the achievement of a desired net worth remains elusive.

3. Wealth Accumulation

Wealth accumulation, a process of increasing financial resources over time, is a critical component in determining an individual's net worth. The magnitude and trajectory of wealth accumulation directly influence the final net worth figure. Factors like income generation, investment returns, and asset appreciation or depreciation all contribute to this process. A thorough understanding of these factors, and their interplay, is key to appreciating the complexities involved in assessing and projecting an individual's financial standing. This principle applies to individuals across various professions and socioeconomic backgrounds, illustrating its universal relevance to financial health.

Examining the causes and effects associated with wealth accumulation provides valuable insights. High-income earners, through substantial salaries and robust investment strategies, often exhibit accelerated accumulation. Conversely, individuals with limited income may experience slower accumulation, potentially requiring more focused strategies and longer time horizons to achieve comparable wealth levels. Moreover, effective financial planning, including budgeting, saving, and investing, significantly accelerates the wealth accumulation process. Entrepreneurs, for example, frequently leverage innovative business models and strategic investments, resulting in exponential growth in wealth. In contrast, individuals neglecting prudent financial practices may see their wealth accumulation stagnate or even decline.

The practical significance of understanding wealth accumulation is multifaceted. For individuals aiming to enhance their financial standing, analyzing effective wealth accumulation strategies becomes essential. Identifying patterns of success, learning from successful cases, and adapting methods to personal circumstances can accelerate the attainment of financial goals. Similarly, institutions or policymakers concerned with economic trends benefit from analyzing patterns of wealth accumulation to formulate policies and interventions, potentially aiming to create more equitable or inclusive systems. In summary, understanding the intricate dynamics of wealth accumulation provides a framework for appreciating and managing personal finances and, on a broader scale, shaping economic policies.

4. Career Progression

Career progression, encompassing advancements in roles, responsibilities, and compensation, is a significant driver of financial success and, consequently, a crucial component of net worth. A demonstrably successful career trajectory often leads to increased earning potential, which directly contributes to the accumulation of wealth. The nature of the career field also plays a significant role. High-demand, specialized professions, like advanced medicine or specialized engineering, frequently correlate with higher earning potential compared to less specialized roles. This differential earning potential directly impacts overall financial resources and impacts the trajectory of net worth.

Specific examples illustrate this connection. A software engineer transitioning from junior developer to senior architect, managing larger teams and more complex projects, commonly witnesses corresponding salary increases. Similarly, an entrepreneur launching a successful startup, through increased revenue and ownership equity, sees their net worth rise substantially, often exponentially, over time. Conversely, stagnant or declining career progression, even in high-paying fields, can lead to a slower accumulation or even a reduction in net worth. This relationship holds across various professions and industries. For instance, a financial analyst securing a leadership position in a global firm will experience a commensurate increase in income and investment opportunities, reflecting a substantial enhancement of their net worth. Conversely, career stagnation or a lateral move without a significant salary increase will not contribute to the same pace of net worth growth.

Understanding the relationship between career progression and net worth is critical for effective financial planning. Individuals can proactively build career paths that align with their financial aspirations. This proactive approach allows individuals to maximize income potential and manage personal finances strategically. Recognizing the long-term effects of career choices on wealth building empowers individuals to make well-informed career decisions and ensures their financial security in the long run. Furthermore, this understanding is crucial for institutions seeking to attract and retain talent, as competitive compensation packages reflect the value of successful career progression and the importance of employee growth in relation to organizational success. By fostering an environment that rewards progression, institutions can create valuable career paths for employees, fostering their personal wealth while simultaneously contributing to the organization's growth.

5. Industry Trends

Industry trends exert a significant influence on an individual's financial standing. Fluctuations in market conditions, technological advancements, and shifts in consumer preferences directly impact the profitability and value of businesses, which, in turn, affect individual incomes and investment opportunities. A thriving sector, characterized by high demand and growth potential, often leads to increased earnings for individuals involved, ultimately enhancing their net worth. Conversely, a declining industry or one facing significant challenges may result in decreased income and asset values, negatively impacting an individual's financial position. This interdependency underscores the importance of considering broader market forces when assessing an individual's financial well-being.

Real-world examples abound. The rise of the digital economy, for instance, created numerous opportunities for entrepreneurs in technology and related sectors. Individuals involved in software development, e-commerce, or online services often saw substantial increases in their net worth as their industries experienced rapid growth. Conversely, the decline of the traditional manufacturing sector in certain regions led to job losses and reduced incomes for those employed in the industry, negatively affecting their financial situations. These examples demonstrate the dynamic relationship between industry trends and individual financial well-being, highlighting the importance of adapting to changing market conditions for long-term financial security.

Understanding the interplay between industry trends and personal finances is crucial for both individuals and organizations. Individuals can leverage their understanding to make informed career and investment choices. For example, anticipating industry shifts allows individuals to adapt their skills and seek opportunities in emerging sectors. Businesses can also use market trends to strategically position themselves for growth and create value for employees and stakeholders. Recognizing the influence of industry trends provides a vital framework for anticipating economic shifts and adjusting financial strategies accordingly, ultimately promoting financial resilience in both personal and professional contexts. This understanding is particularly important during periods of rapid technological advancement, global economic shifts, or emerging market dynamics.

6. Public Perception

Public perception, the collective opinion held by the public about a person or entity, significantly influences an individual's perceived value, and, in some cases, directly impacts quantifiable financial metrics such as net worth. While not a direct, causal factor, public esteem often correlates with perceived value in various domains. This perceived value, in turn, can affect the valuation of personal brands, investments, and even real estate. In the context of an individual's financial standing, the way others view that individual can, in practice, influence the market's valuation of their holdings. For instance, a respected philanthropist might have their charitable donations perceived as having greater impact than an anonymous donor, which, in turn, might drive greater investment interest in their initiatives. Conversely, reputational damage, particularly if linked to scandal or malfeasance, can negatively affect an individual's financial standing, causing a decline in asset values and investment confidence.

Real-life examples illustrate this connection. A celebrity's endorsement can significantly boost a product's sales, reflecting a positive public perception that translates to tangible financial gains. Conversely, a negative public image resulting from questionable behavior can damage the individual's reputation, potentially leading to a decrease in brand value, investment withdrawal, or even legal issues impacting net worth. Moreover, public opinion regarding a company's practices can affect the company's stock valuation and the wealth of its shareholders. A favorable perception regarding environmental consciousness or ethical labor practices, for example, might positively influence investment decisions and consequently drive up share prices. Conversely, unfavorable publicity surrounding environmental damage or exploitation can lead to boycotts and negatively impact stock prices and, therefore, net worth.

Understanding the profound influence of public perception is crucial in several contexts. For individuals seeking to build or maintain a positive public image, it's essential to recognize that this image reflects a substantial component of overall value. Effective communication strategies and ethical conduct become critical tools for cultivating and maintaining favorable public perceptions. Businesses and organizations should actively cultivate a positive brand image, understanding that the perception held by the public significantly influences investment decisions and market share. Recognizing this influence is vital for individuals, organizations, and institutions seeking to achieve long-term financial success. It emphasizes the importance of ethical business practices and transparent communication in maintaining a positive public image and consequently, enhancing the valuation of an individual or entity.

7. Economic Context

Economic context profoundly shapes an individual's financial standing, including their net worth. Economic conditionslike prevailing interest rates, inflation, unemployment, and market fluctuationsinfluence investment opportunities, income levels, and the overall value of assets. Understanding these factors is crucial to interpreting an individual's financial position within a specific time and place.

- Macroeconomic Conditions

Broad economic trends, such as periods of recession or expansion, significantly affect income levels and investment returns. During recessions, employment may decline, impacting disposable income and thus reducing potential for wealth accumulation. Conversely, economic expansions often lead to increased investment opportunities and higher asset values, positively influencing net worth. Examples include the 2008 financial crisis impacting many individuals' investments, and the subsequent recovery demonstrating how economic trends correlate with wealth levels.

- Interest Rates and Inflation

Interest rates affect borrowing costs and investment returns. Rising interest rates can decrease the value of fixed-income investments but can potentially increase returns on loans and other debt instruments. Inflation erodes the purchasing power of money, thus impacting the real value of savings and investments. High inflation can reduce the effective return of savings and reduce overall net worth in real terms if not adjusted for inflation. Examples include periods of high inflation eroding the purchasing power of fixed income, and low interest rates stimulating borrowing and potentially investment.

- Market Fluctuations

Stock market fluctuations directly impact the value of investments held by individuals. Significant market downturns can severely diminish net worth, while periods of market growth can increase asset values. The impact of sector-specific market shifts, such as booms and busts in particular industries, also influences the overall wealth accumulation trends within those fields and, consequently, individuals within them. Examples include the dot-com bubble burst impacting tech investors, and subsequent market recoveries demonstrating how market volatility directly impacts net worth figures.

- Government Policies

Government policies, including tax laws, regulations, and stimulus packages, play a significant role in shaping economic conditions and influencing an individual's wealth. Tax incentives for investment, for example, can encourage saving and investment, leading to wealth accumulation. Conversely, policies that impact income distribution or business regulations can influence an individual's income or investment potential, affecting net worth. Examples include tax laws affecting investment returns, and the impact of stimulus packages on unemployment and consumer confidence.

In conclusion, analyzing the prevailing economic context is essential when evaluating an individual's financial position and net worth. Considering the interplay of macroeconomic conditions, interest rates, market fluctuations, and government policies provides a holistic understanding of the factors influencing wealth accumulation. Such an understanding is vital for interpreting, predicting, and adapting to economic shifts and ultimately informing financial strategies.

Frequently Asked Questions about "Tiny Ti Net Worth"

This section addresses common inquiries regarding the financial standing of "Tiny Ti." Information presented here is based on publicly available data and analysis. A nuanced understanding requires comprehensive financial reporting, which may not always be readily accessible.

Question 1: What is "Tiny Ti Net Worth"?

"Tiny Ti Net Worth" refers to the aggregate value of "Tiny Ti's" assets, minus liabilities. This figure represents a snapshot of their current financial position. Important note: Exact figures may be unavailable due to varying reporting methodologies or the absence of public financial disclosures.

Question 2: How is "Tiny Ti Net Worth" Determined?

Net worth calculations typically involve assessing assets (e.g., investments, real estate) and subtracting liabilities (e.g., debts, loans). The accuracy and comprehensiveness of the valuation depend on the availability and reliability of data from publicly accessible sources.

Question 3: Why is "Tiny Ti Net Worth" Important?

Understanding an individual's net worth provides context for their financial standing. This information can be relevant for various purposes, such as evaluating investment strategies or understanding the economic impact of their activities.

Question 4: What Factors Influence "Tiny Ti Net Worth"?

Multiple factors influence net worth, including income sources, investment performance, debt levels, and economic conditions. These factors interact dynamically, creating fluctuations in the individual's financial standing.

Question 5: Is "Tiny Ti Net Worth" a Reliable Indicator of Success?

While "Tiny Ti Net Worth" provides a measure of financial standing, it should not be considered the sole indicator of success. Other factors, such as societal impact, innovation, or quality of life, may be more important in certain contexts.

Question 6: Where Can I Find More Information on "Tiny Ti Net Worth"?

Reliable information on an individual's net worth often comes from publicly available financial disclosures, reports, or official statements. Scrutinizing these sources is necessary for a reliable assessment.

In summary, understanding "Tiny Ti Net Worth" requires considering its methodology, limitations, and the broader context in which this data is presented. This requires critical evaluation of the available information. Further investigation into specific aspects of "Tiny Ti's" activities and financial position may be necessary for a more comprehensive understanding.

The next section will explore the career trajectory of "Tiny Ti," providing a deeper understanding of their contributions and accomplishments.

Tips for Evaluating and Managing Financial Resources

This section offers practical guidance for evaluating and managing financial resources, aiming to provide actionable steps for individuals seeking to enhance their financial well-being. Accurate assessment and strategic management are crucial for building and preserving wealth.

Tip 1: Comprehensive Financial Planning. Develop a comprehensive financial plan encompassing budgeting, saving, and investment strategies. This plan should align with individual financial goals and risk tolerance, considering short-term and long-term objectives. Examples include retirement planning, funding education, or purchasing a home. A clear plan facilitates informed decision-making, promotes financial discipline, and enhances the probability of achieving desired outcomes.

Tip 2: Diligent Asset Management. Carefully manage assets, whether tangible or intangible, through regular evaluations and adjustments. This includes assessing the value of investments, real estate holdings, and other assets. Diversification across various asset classes mitigates risk. Regular reviews are vital for adapting to evolving economic conditions and maintaining a healthy portfolio.

Tip 3: Realistic Budgeting and Expense Tracking. Develop and implement a realistic budget that aligns with income. Diligent tracking of expenses is essential for identifying areas of potential savings and for making informed spending choices. This includes evaluating discretionary spending and prioritizing essential expenses. Consistent monitoring enables adjustments based on changing circumstances and goals.

Tip 4: Debt Management Strategies. Establish and adhere to a strategy for managing debt. This includes assessing interest rates, repayment terms, and potential consolidation options. Debt reduction should prioritize high-interest debts and prioritize timely payments. Effective debt management contributes to improved credit scores and frees up capital for investment opportunities.

Tip 5: Long-Term Investment Planning. Develop a long-term investment strategy based on risk tolerance and financial goals. Consider the time horizon when making investment decisions. Diversify investments across different asset classes to mitigate risk. Regular reviews and adjustments, aligned with market conditions, are vital for achieving desired outcomes.

Tip 6: Continuous Learning and Adaptability. Stay informed about financial markets, economic trends, and investment strategies. Continuously update knowledge and adjust strategies based on evolving circumstances. Financial knowledge allows for proactive adaptation and mitigates risks associated with unexpected changes.

By implementing these strategies, individuals can effectively manage their financial resources, enhance their financial security, and achieve their financial objectives. This meticulous approach fosters greater financial well-being.

The subsequent sections will explore specific case studies and real-world examples, demonstrating the practical application of these tips.

Conclusion

This analysis of "Tiny Ti's" financial standing has explored the multifaceted factors contributing to net worth. The assessment considered financial resources, encompassing assets, income streams, and debt obligations. Further, the analysis examined investment strategies, highlighting their impact on wealth accumulation. Career progression and industry trends were also examined, underscoring their influence on earning potential. Finally, the role of public perception and economic context in shaping financial outcomes was discussed. These interconnected factors contribute to a nuanced understanding of the complexities involved in evaluating an individual's financial position. While precise figures for "Tiny Ti's" net worth were not readily available, the framework presented here allows for a broader comprehension of the forces that shape financial success.

The evaluation of financial standing extends beyond simple numerical values. It requires a holistic view, considering the interplay of personal choices, market forces, and broader economic trends. The analysis underscores the dynamic and complex nature of financial accumulation. By understanding these interconnected factors, individuals and institutions can develop more informed strategies for wealth building and management. Further research into specific industry dynamics or career paths might further refine the understanding of "Tiny Ti's" financial situation, providing additional context for future analysis.

Article Recommendations

- The Unfolding Story Of Betty Broderick Uncovering The Truth Today

- Top Michaels Jobs Career Opportunities

- Stunning Short Hairstyles For Fine Hair Over 60 Effortless Chic